[fusion_builder_container type=”flex” hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” align_content=”stretch” flex_align_items=”flex-start” flex_justify_content=”flex-start” hundred_percent_height_center_content=”yes” equal_height_columns=”no” container_tag=”div” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” border_style=”solid” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_blend_mode=”none” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” pattern_bg=”none” pattern_bg_style=”default” pattern_bg_opacity=”100″ pattern_bg_blend_mode=”normal” mask_bg=”none” mask_bg_style=”default” mask_bg_opacity=”100″ mask_bg_transform=”left” mask_bg_blend_mode=”normal” absolute=”off” absolute_devices=”small,medium,large” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” sticky_transition_offset=”0″ scroll_offset=”0″ animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ admin_label=”Post Content”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ align_self=”auto” content_layout=”column” align_content=”flex-start” valign_content=”flex-start” content_wrap=”wrap” center_content=”no” column_tag=”div” target=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” order_medium=”0″ order_small=”0″ hover_type=”none” border_style=”solid” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ z_index_subgroup=”regular” background_type=”single” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ lazy_load=”none” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” absolute=”off” filter_type=”regular” filter_hover_element=”self” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ transform_type=”regular” transform_hover_element=”self” transform_scale_x=”1″ transform_scale_y=”1″ transform_translate_x=”0″ transform_translate_y=”0″ transform_rotate=”0″ transform_skew_x=”0″ transform_skew_y=”0″ transform_scale_x_hover=”1″ transform_scale_y_hover=”1″ transform_translate_x_hover=”0″ transform_translate_y_hover=”0″ transform_rotate_hover=”0″ transform_skew_x_hover=”0″ transform_skew_y_hover=”0″ transition_duration=”300″ transition_easing=”ease” animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ spacing_left=”100px” spacing_right=”100px” last=”true” border_position=”all” first=”true” min_height=”” link=””][fusion_global id=”2335″][fusion_global id=”2336″][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”” rule_size=”” rule_color=”” hue=”” saturation=”” lightness=”” alpha=”” user_select=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” text_color=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” logics=””]

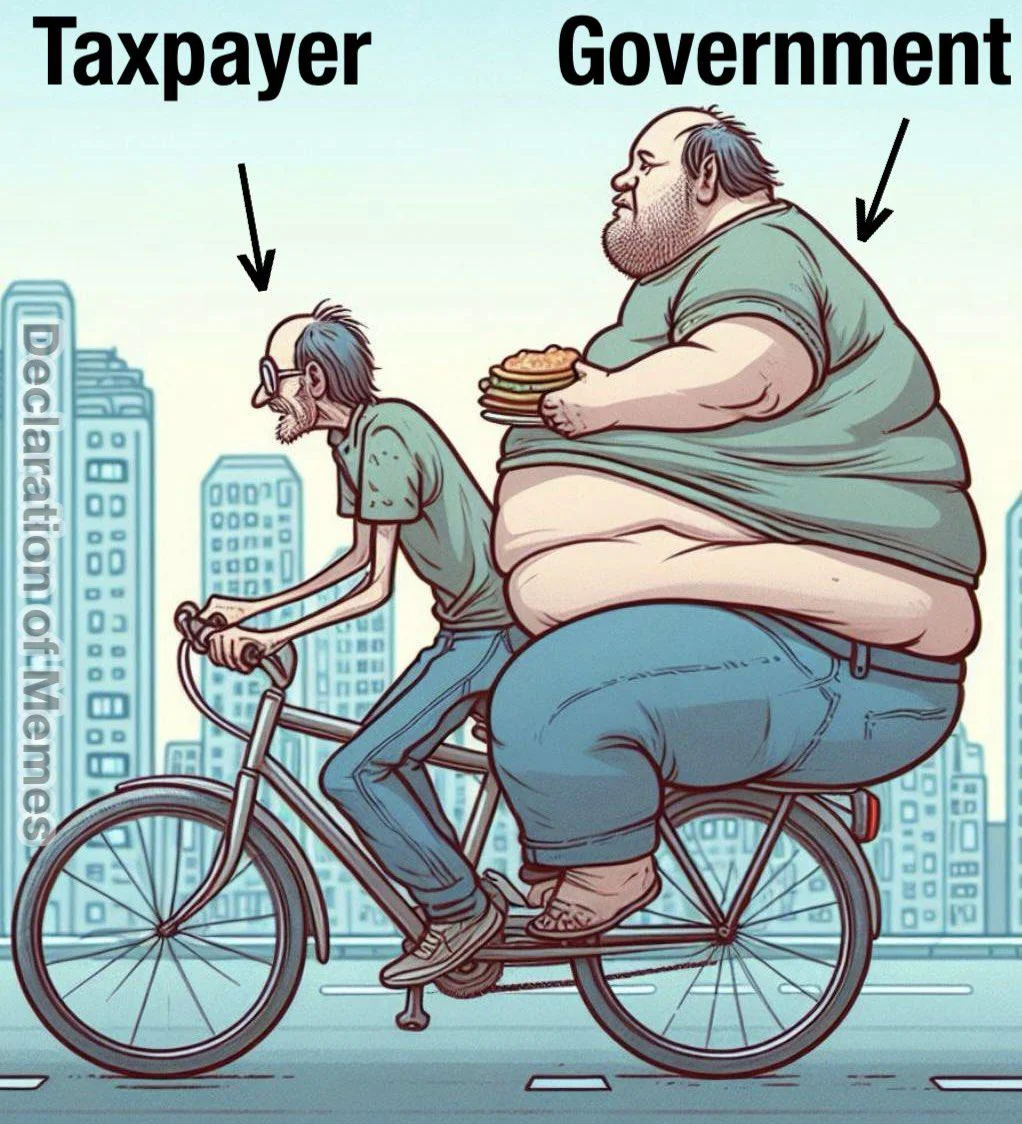

A low-tax economy has proven time and again to be a powerful tool for driving economic growth, fostering innovation, and creating jobs. As the United Kingdom looks to solidify its position in a post-Brexit world, adopting a low-tax approach could play a pivotal role in ensuring long-term economic prosperity. Drawing from both empirical research and evidence from other countries, it is clear that reducing tax rates can significantly enhance the nation’s economic performance, with particular benefits for small and medium-sized enterprises (SMEs), which are the backbone of the UK economy.

1. Economic Growth and Job Creation

Lower tax rates have a direct and positive impact on economic growth, as they encourage investment, consumption, and overall economic activity. Research by Mertens and Ravn (2018), analysing U.S. tax cuts from 1946 to 2012, found that a 1-percentage-point reduction in marginal tax rates led to a 0.78% increase in real GDP within three years (Tax Foundation). This demonstrates that cutting taxes can stimulate the broader economy by increasing disposable income and encouraging businesses to invest more in expansion and job creation. It also demonstrates the previous and current government’s woeful lack of understanding of the UK economy.

In the context of the UK, where growth is a critical post-Brexit priority, such evidence suggests that a reduction in both corporate and personal tax rates could be a powerful lever to drive GDP growth. The Institute of Economic Affairs (IEA) has argued that high taxes stifle innovation and business growth, making the economy less competitive. Lowering taxes can reverse this trend, boosting productivity and innovation, both of which are key to long-term economic health.

[/fusion_text][fusion_builder_row_inner][fusion_builder_column_inner type=”1_1″ layout=”1_1″ align_self=”auto” content_layout=”column” align_content=”center” valign_content=”flex-start” content_wrap=”wrap” spacing=”” center_content=”no” column_tag=”div” link=”” target=”_self” link_description=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” type_medium=”” type_small=”” flex_grow_medium=”” flex_grow_small=”” flex_grow=”” flex_shrink_medium=”” flex_shrink_small=”” flex_shrink=”” order_medium=”0″ order_small=”0″ spacing_left_medium=”” spacing_right_medium=”” spacing_left_small=”” spacing_right_small=”” spacing_left=”10px” spacing_right=”0px” margin_top_medium=”” margin_bottom_medium=”” margin_top_small=”” margin_bottom_small=”” margin_top=”” margin_bottom=”” padding_top_medium=”” padding_right_medium=”” padding_bottom_medium=”” padding_left_medium=”” padding_top_small=”” padding_right_small=”” padding_bottom_small=”” padding_left_small=”” padding_top=”35px” padding_right=”” padding_bottom=”35px” padding_left=”” hover_type=”none” border_sizes_top=”” border_sizes_right=”” border_sizes_bottom=”” border_sizes_left=”” border_color_hover=”” hue=”” saturation=”” lightness=”” alpha=”” border_color=”” border_style=”solid” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_right=”” border_radius_bottom_left=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” z_index_hover=”” z_index=”” overflow=”” background_type=”single” background_color_medium=”” background_color_small=”” background_color_medium_hover=”” background_color_small_hover=”” background_color_hover=”” background_color=”” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ background_image_medium=”” background_image_small=”” background_image=”” background_image_id_medium=”” background_image_id_small=”” background_image_id=”” lazy_load=”none” skip_lazy_load=”” background_position_medium=”” background_position_small=”” background_position=”left top” background_repeat_medium=”” background_repeat_small=”” background_repeat=”no-repeat” background_size_medium=”” background_size_small=”” background_size=”” background_custom_size=”” background_custom_size_medium=”” background_custom_size_small=”” background_blend_mode_medium=”” background_blend_mode_small=”” background_blend_mode=”none” background_slider_images=”” background_slider_position=”” background_slider_skip_lazy_loading=”no” background_slider_loop=”yes” background_slider_pause_on_hover=”no” background_slider_slideshow_speed=”5000″ background_slider_animation=”fade” background_slider_direction=”up” background_slider_animation_speed=”800″ background_slider_blend_mode=”” render_logics=”” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” sticky_offset=”” absolute=”off” absolute_top=”” absolute_right=”” absolute_bottom=”” absolute_left=”” filter_type=”regular” filter_hover_element=”self” filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ transform_type=”regular” transform_hover_element=”self” transform_scale_x_hover=”1″ transform_scale_y_hover=”1″ transform_translate_x_hover=”0″ transform_translate_y_hover=”0″ transform_rotate_hover=”0″ transform_skew_x_hover=”0″ transform_skew_y_hover=”0″ transform_scale_x=”1″ transform_scale_y=”1″ transform_translate_x=”0″ transform_translate_y=”0″ transform_rotate=”0″ transform_skew_x=”0″ transform_skew_y=”0″ transform_origin=”” transition_duration=”300″ transition_easing=”ease” transition_custom_easing=”” motion_effects=”W10=” scroll_motion_devices=”small-visibility,medium-visibility,large-visibility” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” last=”true” border_position=”all” first=”true”][fusion_imageframe image_id=”2151|full” aspect_ratio=”” custom_aspect_ratio=”100″ aspect_ratio_position=”” skip_lazy_load=”” lightbox=”no” gallery_id=”” lightbox_image=”” lightbox_image_id=”” alt=”” link=”” linktarget=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” max_width=”” sticky_max_width=”” align_medium=”none” align_small=”none” align=”center” mask=”” custom_mask=”” mask_size=”” mask_custom_size=”” mask_position=”” mask_custom_position=”” mask_repeat=”” style_type=”” blur=”” stylecolor=”” hue=”” saturation=”” lightness=”” alpha=”” hover_type=”zoomin” magnify_full_img=”” magnify_duration=”120″ scroll_height=”100″ scroll_speed=”1″ margin_top_medium=”” margin_right_medium=”” margin_bottom_medium=”” margin_left_medium=”” margin_top_small=”” margin_right_small=”” margin_bottom_small=”” margin_left_small=”” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” bordersize=”” bordercolor=”” borderradius=”” z_index=”” caption_style=”off” caption_align_medium=”none” caption_align_small=”none” caption_align=”none” caption_title=”” caption_text=”” caption_title_tag=”2″ fusion_font_family_caption_title_font=”” fusion_font_variant_caption_title_font=”” caption_title_size=”” caption_title_line_height=”” caption_title_letter_spacing=”” caption_title_transform=”” caption_title_color=”hsla(var(–awb-color1-h),var(–awb-color1-s),var(–awb-color1-l),calc(var(–awb-color1-a) – 100%))” caption_background_color=”” fusion_font_family_caption_text_font=”” fusion_font_variant_caption_text_font=”” caption_text_size=”” caption_text_line_height=”” caption_text_letter_spacing=”” caption_text_transform=”” caption_text_color=”” caption_border_color=”” caption_overlay_color=”hsla(var(–awb-color8-h),var(–awb-color8-s),var(–awb-color8-l),calc(var(–awb-color8-a) – 50%))” caption_margin_top=”” caption_margin_right=”” caption_margin_bottom=”” caption_margin_left=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″]https://www.reformuknorthyorks.uk/wp-content/uploads/2023/03/situation-of-middle-class-taxpayer.webp[/fusion_imageframe][/fusion_builder_column_inner][/fusion_builder_row_inner][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”” rule_size=”” rule_color=”” hue=”” saturation=”” lightness=”” alpha=”” user_select=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” margin_top=”20px” margin_right=”” margin_bottom=”50px” margin_left=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” text_color=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” logics=””]

2. Encouraging Investment and Business Expansion

Empirical evidence also highlights the importance of low corporate taxes in attracting business investment. A 2018 study by Ljungqvist and Smolyansky, which analysed 250 corporate tax changes in the U.S. from 1970 to 2010, found that a 1% cut in corporate taxes increased employment by 0.2% and wages by 0.3% (Tax Foundation). For the UK, reducing corporate taxes could yield similar benefits, attracting both domestic and international firms to invest more in the economy. Post-Brexit, this would make the UK more competitive, positioning it as a magnet for global businesses. These opportunities were clumsily missed by the last Consocialist administration, and are being cynically ignored by the current Labour government.

Ireland provides a compelling case study. Its low corporate tax rate of 12.5% has been instrumental in turning the country into a hub for multinational corporations. In 2022, foreign direct investment (FDI) into Ireland exceeded €350 billion, largely due to its favourable tax policies (Tax Foundation). For the UK, lowering corporate taxes could replicate Ireland’s success, attracting international businesses while fostering a dynamic domestic entrepreneurial environment.

3. Benefits to Small and Medium-Sized Enterprises (SMEs)

SMEs, comprising over 5.5 million businesses, form the backbone of the UK economy, accounting for around 99.9% of all businesses and employing over 16 million people (Brookings). A low-tax regime would deliver significant benefits to these businesses, enabling them to reinvest their profits, expand, and create more jobs. According to a study by the Federation of Small Businesses (FSB), SMEs benefiting from reduced corporate taxes were able to reinvest an additional £2,500 annually, contributing to greater innovation and productivity (Brookings). Rachel Reeves, in her Autumn Budget 2024, ignored this evidence, however, and increased taxes for virtually every small business in the country.

Lower personal income taxes would also benefit SME owners, who often face significant personal financial risks when starting or expanding their businesses. By reducing taxes on small businesses and entrepreneurs, the government would create an environment where innovation thrives, making it easier for SMEs to hire more staff, expand operations, and compete on a global scale.

The evidence from Switzerland further underscores this point. Swiss SMEs benefit from the country’s low corporate tax regime, which ranges from 11.9% to 21.6%, depending on the canton. A 2020 study revealed that 99% of businesses in Switzerland are SMEs, which employ 70% of the private-sector workforce (Tax Foundation). By adopting a similar low-tax strategy, the UK can enhance the competitiveness of its SMEs, allowing them to drive economic growth.

[/fusion_text][fusion_builder_row_inner][fusion_builder_column_inner type=”10.00″ layout=”10.00″ align_self=”auto” content_layout=”column” align_content=”flex-start” valign_content=”flex-start” content_wrap=”wrap” center_content=”no” column_tag=”div” target=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” order_medium=”0″ order_small=”0″ hover_type=”none” border_style=”solid” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ z_index_subgroup=”regular” background_type=”single” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ lazy_load=”none” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” absolute=”off” filter_type=”regular” filter_hover_element=”self” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ transform_type=”regular” transform_hover_element=”self” transform_scale_x=”1″ transform_scale_y=”1″ transform_translate_x=”0″ transform_translate_y=”0″ transform_rotate=”0″ transform_skew_x=”0″ transform_skew_y=”0″ transform_scale_x_hover=”1″ transform_scale_y_hover=”1″ transform_translate_x_hover=”0″ transform_translate_y_hover=”0″ transform_rotate_hover=”0″ transform_skew_x_hover=”0″ transform_skew_y_hover=”0″ transition_duration=”300″ transition_easing=”ease” animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ last=”false” border_position=”all” element_content=”” first=”true” min_height=”” link=””][/fusion_builder_column_inner][fusion_builder_column_inner type=”4_5″ layout=”4_5″ align_self=”auto” content_layout=”column” align_content=”flex-start” valign_content=”flex-start” content_wrap=”wrap” center_content=”no” column_tag=”div” target=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” order_medium=”0″ order_small=”0″ hover_type=”none” border_style=”solid” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ z_index_subgroup=”regular” background_type=”single” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ lazy_load=”none” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” absolute=”off” filter_type=”regular” filter_hover_element=”self” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ transform_type=”regular” transform_hover_element=”self” transform_scale_x=”1″ transform_scale_y=”1″ transform_translate_x=”0″ transform_translate_y=”0″ transform_rotate=”0″ transform_skew_x=”0″ transform_skew_y=”0″ transform_scale_x_hover=”1″ transform_scale_y_hover=”1″ transform_translate_x_hover=”0″ transform_translate_y_hover=”0″ transform_rotate_hover=”0″ transform_skew_x_hover=”0″ transform_skew_y_hover=”0″ transition_duration=”300″ transition_easing=”ease” animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ background_color=”hsla(var(–awb-color2-h),var(–awb-color2-s),calc(var(–awb-color2-l) + 2%),var(–awb-color2-a))” padding_top=”50px” padding_right=”50px” padding_bottom=”50px” padding_left=”50px” border_sizes_left=”5px” border_color=”var(–awb-color4)” last=”false” border_position=”all” first=”false” margin_bottom=”25″ min_height=”” link=””][fusion_text animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” margin_bottom=”0px”]SMEs form the backbone of the UK economy, accounting for around 99.9% of all businesses and employing over 16 million people(Brookings).

A low-tax regime would deliver significant benefits to these businesses, enabling them to reinvest their profits, expand, and create more jobs[/fusion_text][/fusion_builder_column_inner][fusion_builder_column_inner type=”10.00″ layout=”10.00″ align_self=”auto” content_layout=”column” align_content=”flex-start” valign_content=”flex-start” content_wrap=”wrap” center_content=”no” column_tag=”div” target=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” order_medium=”0″ order_small=”0″ hover_type=”none” border_style=”solid” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ z_index_subgroup=”regular” background_type=”single” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ lazy_load=”none” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” absolute=”off” filter_type=”regular” filter_hover_element=”self” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ transform_type=”regular” transform_hover_element=”self” transform_scale_x=”1″ transform_scale_y=”1″ transform_translate_x=”0″ transform_translate_y=”0″ transform_rotate=”0″ transform_skew_x=”0″ transform_skew_y=”0″ transform_scale_x_hover=”1″ transform_scale_y_hover=”1″ transform_translate_x_hover=”0″ transform_translate_y_hover=”0″ transform_rotate_hover=”0″ transform_skew_x_hover=”0″ transform_skew_y_hover=”0″ transition_duration=”300″ transition_easing=”ease” animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ last=”true” border_position=”all” element_content=”” first=”false” min_height=”” link=””][/fusion_builder_column_inner][/fusion_builder_row_inner][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”” rule_size=”” rule_color=”” hue=”” saturation=”” lightness=”” alpha=”” user_select=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” text_color=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” logics=””]

4. Tax Competitiveness in a Global Economy

In today’s interconnected world, capital and businesses are highly mobile. Nations with high tax rates often struggle to retain businesses and attract foreign investment. This is particularly relevant for the UK, which must now compete with countries like Ireland and Singapore for foreign direct investment. The current UK corporate tax rate of 25% places it at a disadvantage compared to countries with lower rates, such as Ireland (12.5%) and Switzerland (ranging from 11.9% to 21.6%) (Tax Foundation)(Brookings). The Government needs to wake up fast to this reality, otherwise the UK will rapidly fall behind the rest of the world and our economic decline will become irreversible.

Lowering taxes in the UK would enhance its global competitiveness, ensuring that it remains an attractive destination for businesses, particularly if the country is to leverage the opportunities of Brexit. The OECD has also highlighted the importance of tax competitiveness in attracting multinational corporations, whose investment decisions are often influenced by tax policies (Tax Foundation).

[/fusion_text][fusion_builder_row_inner][fusion_builder_column_inner type=”1_1″ layout=”1_2″ align_self=”auto” content_layout=”column” align_content=”flex-start” valign_content=”flex-start” content_wrap=”wrap” center_content=”no” column_tag=”div” target=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” order_medium=”0″ order_small=”0″ hover_type=”none” border_style=”solid” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ z_index_subgroup=”regular” background_type=”single” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ lazy_load=”none” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” absolute=”off” filter_type=”regular” filter_hover_element=”self” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ transform_type=”regular” transform_hover_element=”self” transform_scale_x=”1″ transform_scale_y=”1″ transform_translate_x=”0″ transform_translate_y=”0″ transform_rotate=”0″ transform_skew_x=”0″ transform_skew_y=”0″ transform_scale_x_hover=”1″ transform_scale_y_hover=”1″ transform_translate_x_hover=”0″ transform_translate_y_hover=”0″ transform_rotate_hover=”0″ transform_skew_x_hover=”0″ transform_skew_y_hover=”0″ transition_duration=”300″ transition_easing=”ease” animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ padding_top=”15px” last=”true” border_position=”all” first=”true” min_height=”” link=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”” rule_size=”” rule_color=”” hue=”” saturation=”” lightness=”” alpha=”” user_select=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” text_color=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” logics=””]

5. The Laffer Curve and Optimal Taxation

The Laffer Curve concept suggests that there is an optimal tax rate that maximises revenue without stifling economic activity. At high tax rates, tax revenues decline because individuals and businesses are disincentivised to work, invest, and produce. Studies have shown that tax increases in high-tax countries like France and Germany led to reduced GDP growth, with a tax multiplier of -3.6 (Tax Foundation). For the UK, this evidence points to the need to find an optimal tax rate that promotes growth while maintaining sufficient revenue for government services.

A report by the U.S. Small Business Administration (SBA) demonstrated how tax cuts can encourage entrepreneurship. After the Tax Cuts and Jobs Act of 2017 in the U.S., there was a 7.4% increase in new business applications the following year (Tax Foundation). The UK could experience a similar boost in entrepreneurial activity by adopting a low-tax strategy, especially for startups and small businesses.

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner][fusion_builder_row_inner][fusion_builder_column_inner type=”1_1″ layout=”1_2″ align_self=”auto” content_layout=”column” align_content=”flex-start” valign_content=”flex-start” content_wrap=”wrap” center_content=”no” column_tag=”div” target=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” order_medium=”0″ order_small=”0″ hover_type=”none” border_style=”solid” box_shadow=”no” box_shadow_blur=”0″ box_shadow_spread=”0″ z_index_subgroup=”regular” background_type=”single” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ lazy_load=”none” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” absolute=”off” filter_type=”regular” filter_hover_element=”self” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ transform_type=”regular” transform_hover_element=”self” transform_scale_x=”1″ transform_scale_y=”1″ transform_translate_x=”0″ transform_translate_y=”0″ transform_rotate=”0″ transform_skew_x=”0″ transform_skew_y=”0″ transform_scale_x_hover=”1″ transform_scale_y_hover=”1″ transform_translate_x_hover=”0″ transform_translate_y_hover=”0″ transform_rotate_hover=”0″ transform_skew_x_hover=”0″ transform_skew_y_hover=”0″ transition_duration=”300″ transition_easing=”ease” animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″ padding_top=”25px” last=”true” border_position=”all” first=”true” background_color=”var(–awb-color2)” padding_right=”25px” padding_bottom=”25″ padding_left=”25″ margin_top=”25″ min_height=”” link=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”” rule_size=”” rule_color=”” hue=”” saturation=”” lightness=”” alpha=”” user_select=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” text_color=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” logics=””]

Conclusion

Empirical evidence from both the UK and international case studies makes a compelling case for a low-tax economy. Countries like Ireland, Switzerland, and Singapore have demonstrated the powerful impact that low taxes can have on growth, investment, and innovation. For the UK, adopting a low-tax regime would boost GDP, foster entrepreneurial activity, and make the country more competitive in the global economy. Additionally, small businesses—the lifeblood of the UK economy—would benefit from reinvestment opportunities, job creation, and a more dynamic business environment.

As the UK seeks to redefine its economic future in a post-Brexit world, embracing a low-tax approach offers a proven path to ensuring long-term prosperity, fiscal health, and global competitiveness.

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner][fusion_text columns=”” rule_size=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ logics=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky”]

References

Mertens, K., & Ravn, M. O. (2018). The Dynamic Effects of Personal and Corporate Income Tax Changes in the United States. Journal of Political Economy. Tax Foundation summary available at taxfoundation.org.

Institute of Economic Affairs (IEA). (2022). Impact of High Taxes on Innovation and Business Growth. Available at iea.org.uk.

Ljungqvist, A., & Smolyansky, M. (2018). The Economic Effects of Corporate Tax Changes: Evidence from State-Level Variation in the U.S.. American Economic Review, Tax Foundation summary. Available at taxfoundation.org.

Tax Foundation. (2022). Tax Competitiveness Index and Country Profiles. Tax Foundation. Retrieved from taxfoundation.org.

Brookings Institution. (2022). The Role of SMEs in the UK Economy and the Impact of Tax Policy. Brookings Institution Reports. Available at brookings.edu.

Federation of Small Businesses (FSB). (2019). Benefits of Reduced Corporate Taxes for SMEs in the UK. Federation of Small Businesses Reports. Available at fsb.org.uk.

Swiss Federal Tax Administration. (2020). Corporate Taxation in Switzerland and Economic Impact on SMEs. Swiss Federal Tax Administration. Accessed at admin.ch.

Organisation for Economic Co-operation and Development (OECD). (2021). Tax Policy and Economic Growth: Evidence and Analysis. OECD Reports. Available at oecd.org.

U.S. Small Business Administration (SBA). (2019). The Impact of Tax Cuts on Entrepreneurship: Evidence from the Tax Cuts and Jobs Act of 2017. Small Business Administration. Available at sba.gov.

[/fusion_text][fusion_text columns=”” rule_size=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ logics=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky”][/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

A real insight into how robbing the taxpayer AND wasting their money will have devastating , perhaps irreversible, effects on the UK economy. REFORM of our tax system is vital!